The housing market hasn’t felt this energized in a long time – and the numbers backing that up are hard to ignore. Mortgage rates have eased almost a full percentage point this year, and that shift is starting to wake up buyers.

Home loan applications have risen . Activity has picked up . And sellers who step in early could benefit from the momentum long before the competition catches on.

Let’s take a look at what’s happening behind the scenes and how you can take advantage of it.

When Rates Come Down, Buyer Activity Goes Up

In today’s market, buyer demand is closely tied to what happens with mortgage rates. As rates come down , applications for home loans go up . Rick Sharga, Founder and CEO of the CJ Patrick Company , explains it like this:

“We’re in an incredibly rate-sensitive environment today, and every time we’ve seen mortgage rates drop into the low-to-mid 6% range, we’ve seen an influx of buyers hit the market. ”

And that’s exactly what the data shows. More people who were sidelined are applying for mortgages again now that borrowing costs have come down. Of course, that’s going to ebb and flow just like rates ebb and flow. But the bigger picture is, there’s been improvement as a whole since rates started coming down.

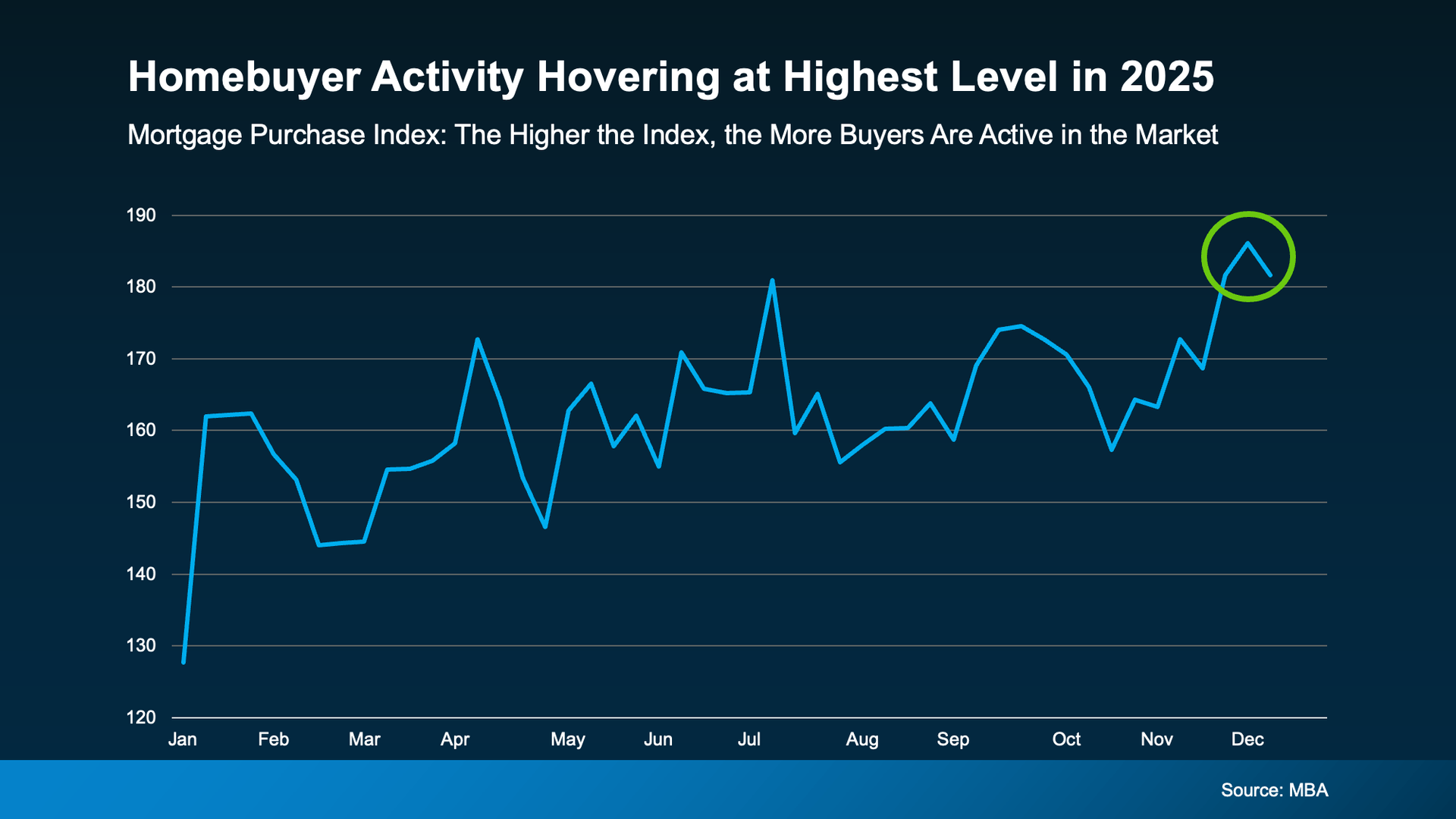

In fact, the Mortgage Bankers Association (MBA) shows the Mortgage Purchase Index is hovering at the highest level so far this year:

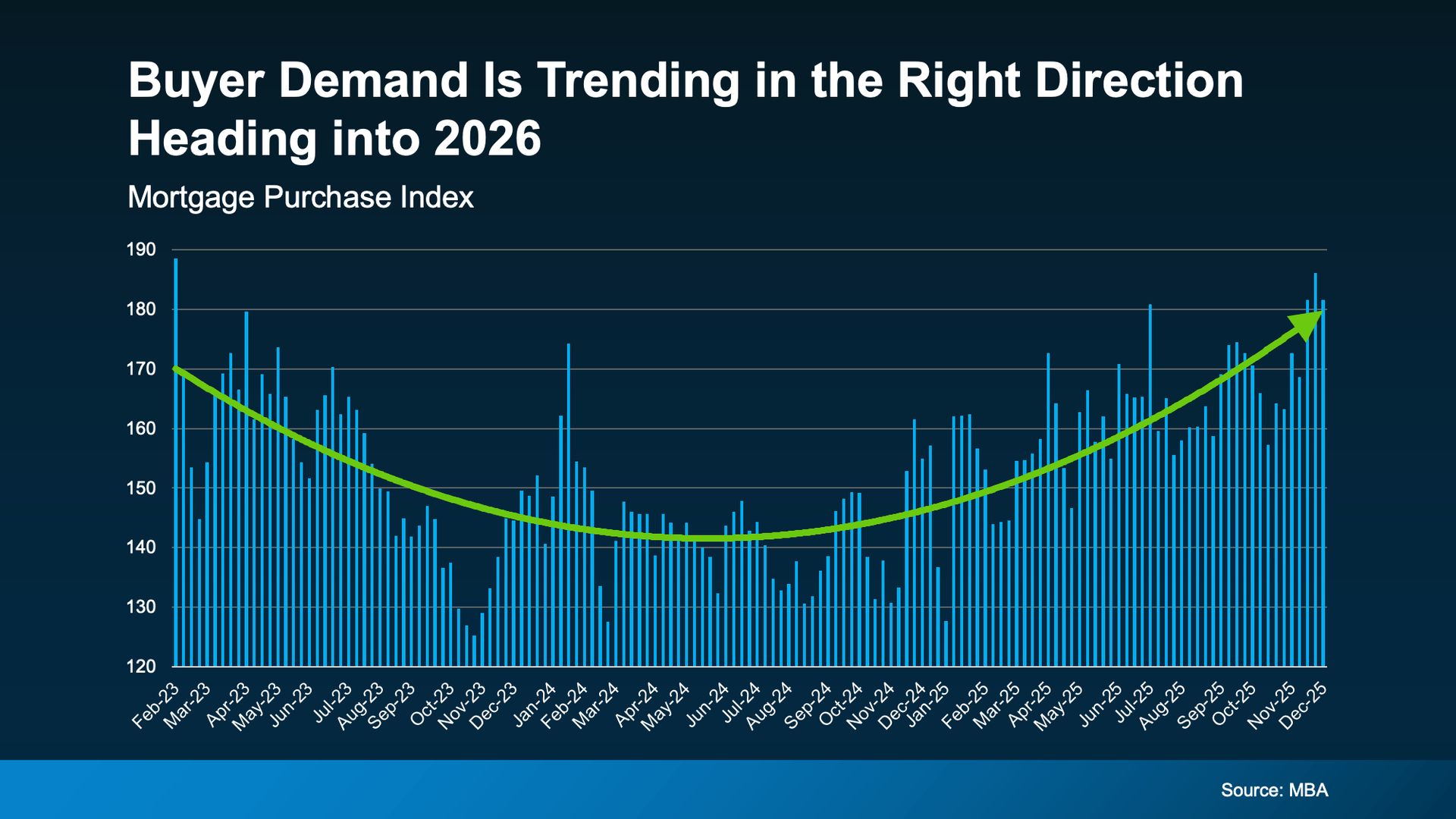

And that's not the only sign of optimism. MBA also shows mortgage applications recently hit their highest point in almost 3 years too. A clear sign demand is moving in the right direction heading into

2026

:

And that's not the only sign of optimism. MBA also shows mortgage applications recently hit their highest point in almost 3 years too. A clear sign demand is moving in the right direction heading into

2026

:

And just in case you were wondering, it’s not just pent-up demand coming out of the government shutdown that slowed some of the processing of government loans for a month or so. If you look back at the last graph, you’ll see the steady build-up of momentum throughout the entire year.

And just in case you were wondering, it’s not just pent-up demand coming out of the government shutdown that slowed some of the processing of government loans for a month or so. If you look back at the last graph, you’ll see the steady build-up of momentum throughout the entire year.

The big takeaway for you is this. Now that rates have come down, buyers are starting to ease back into the game. And that’s turning into real contracts on homes just like yours.

Home Sales Are Rebounding

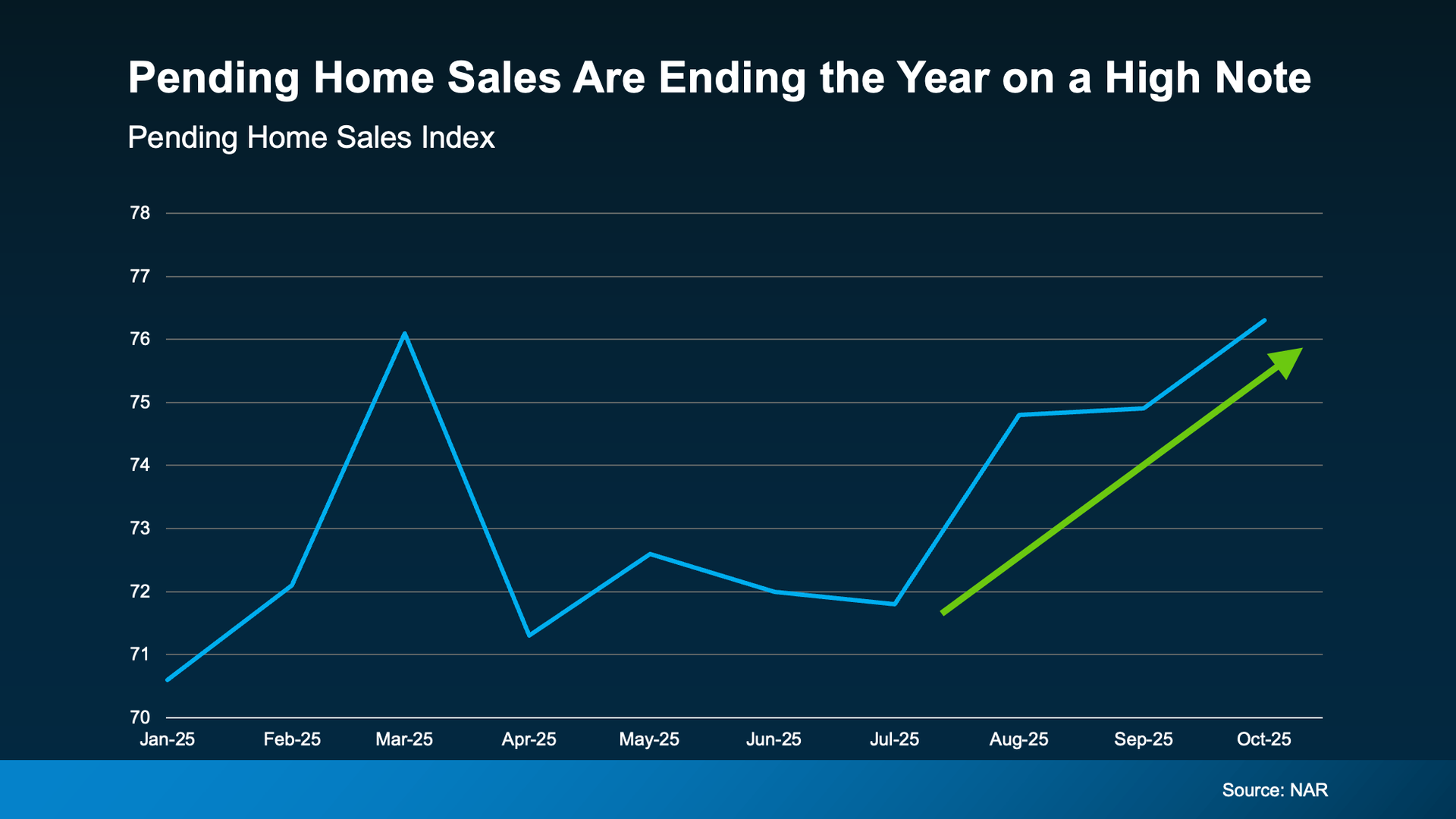

Just to really drive home that this is trending in a good direction, the most recent report from the National Association of Realtors (NAR) shows pending home sales (homes that are under contract) are picking up too. The Pending Home Sales Index is also at the highest it’s been all year ( see graph below ):

And that means the market is ending the year on a high note and headed into 2026 with renewed energy.

While that may not seem like a big shift, it’s a rebound worth talking about.

And that means the market is ending the year on a high note and headed into 2026 with renewed energy.

While that may not seem like a big shift, it’s a rebound worth talking about.

Pending home sales are a leading indicator of where actual sales are going. If more homes are going under contract, it’s a good sign more homes will actually close over the next two months, ultimately boosting sales. This could be part of why experts project home sales will inch higher in 2026 than they were in 2025 or in 2024.

Of course, this may ebb and flow a bit as we see some year-end volatility with mortgage rates. But, it shouldn’t be enough to change this overall trend. Expert forecasts say rates should stay pretty much where they are throughout 2026. That means the stage is set for this momentum to continue going into the new year.

What This Means for You

Here’s the opportunity. Selling now means:

- More buyer demand. As affordability improves, you could see more buyer traffic and home showings (if your house is priced and staged right). And the best part? The buyers who are re-engaging feel like they’ve already waited too long for this moment. So, they’ll be eager to move.

- Being ahead of the curve. Listing sooner rather than later puts you ahead of the game, before other sellers realize something's shifted.

Whether you’ve been putting off selling because you thought buyers weren’t buying, or you took your house off the market because you weren’t getting any bites, this is your sign to act.

Bottom Line

Want to know what's happening with buyer activity in your area, and what it could mean if you want to sell your house in the new year?

Talk to an agent about getting your house listed in early 2026, so you can take advantage of this momentum building in the market.